‘My dad went to bed hungry’ remembers Donaldsonville Mayor, a child tax credit supporter

Less than a mile down the street from Donaldsonville’s City Hall in the historic district, movie crews setup for months long taping of “Grilled Cheese,” a new project by director Ryan Coogler. It is one of 14 movies taped in Donaldsonville since 2002.

The city, which is benefiting from the growing demands of “Hollywood South,” is uniquely a historic, rural town beyond sugarcane fields and an active petrochemical plant. Not so unique, however, are the numbers of families who live in poverty. That number hovers around 45-46%, said Mayor Leroy J. Sullivan Sr.

A native of Donaldsonville, he remembers the times his father would stop eating, give the last of his dinner to his son, and walk away from the dinner table.

“It wasn’t until I was a grown man that I realized my dad went to bed hungry a lot of nights to make sure that I had enough,” Sullivan said. “That’s what a parent is going to do.”

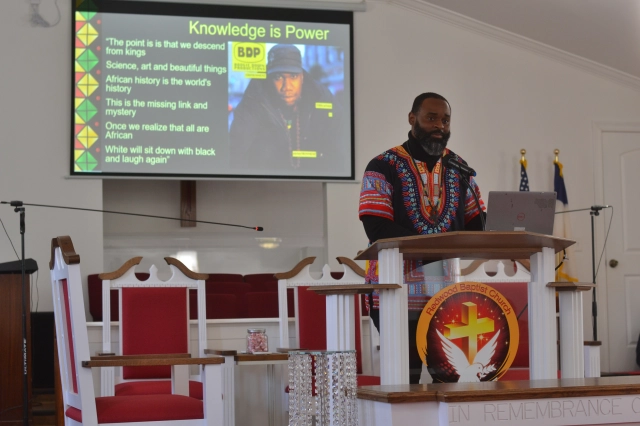

As mayor, he sees residents grappling with daily uncertainties and trying to make ends meet. Earlier this year, he sat with members of the Middleburg Institute as part of a 10-city child tax credit awareness campaign to discuss the economic security for Louisiana residents. For ten years, The Middleburg Institute has advocated for economic policies like tax credits that can benefit moderate and low income communities.

Watching Congress

Like many leaders across the nation, Sullivan is watching the ongoing decisions around the federal child tax credit, hopeful that it will provide much-needed financial assistance to residents.

The Tax Relief for American Families and Workers Act of 2024 passed the US House of Representatives and is being contested in the Senate. Working taxpayers, who earn up to $400,000 as joint filers or $200,000 as single filers, would receive a tax credit, or deduction, from the taxes they would otherwise owe, explained David Lindenfeld of the Together Baton Rouge Tax Fairness Team. The maximum credit under current law is $2,000 for each child under age 17.

“You have a lot of people with income subsidized by other programs and the child tax credit program was something that enabled them to have extra funding to be able to buy groceries, to be able to pay utility bills, and to find a better place to live or work,” Sullivan said as he explained the vital role of the federal child tax credit program has in supporting families facing economic hardships.

A Win-Win

Sullivan said financial initiatives have far-reaching positive impact on crime reduction and educational outcomes. “When you have programs that can assist, (parents) don’t have to think about doing the things that are unthinkable or not good for them or their family,” and children can concentrate on learning and not being hungry, he said.

According to Lindenfeld, the child tax credit was estimated to have lifted nearly 3 million children out of poverty in 2016. During the coronavirus pandemic, an expanded version of the child tax credit gave families monthly payments, rather than have them wait for filing taxes. This was key to reducing poverty by half, he said.

“Any program that can help (citizens), is a win-win, not just for our community. But for the federal government as a whole,” Sullivan said. More than 100 grassroots advocates and leaders like Sullivan will continue this discussion at the Middleburg Institute’s Policy Stimulator and Silver Soiree in Baton Rouge on April 12.